-

UK royal finances in spotlight after Andrew's downfall

UK royal finances in spotlight after Andrew's downfall

-

Diplomatic shift and elections see Armenia battle Russian disinformation

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

Epstein fallout triggers resignations, probes

-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

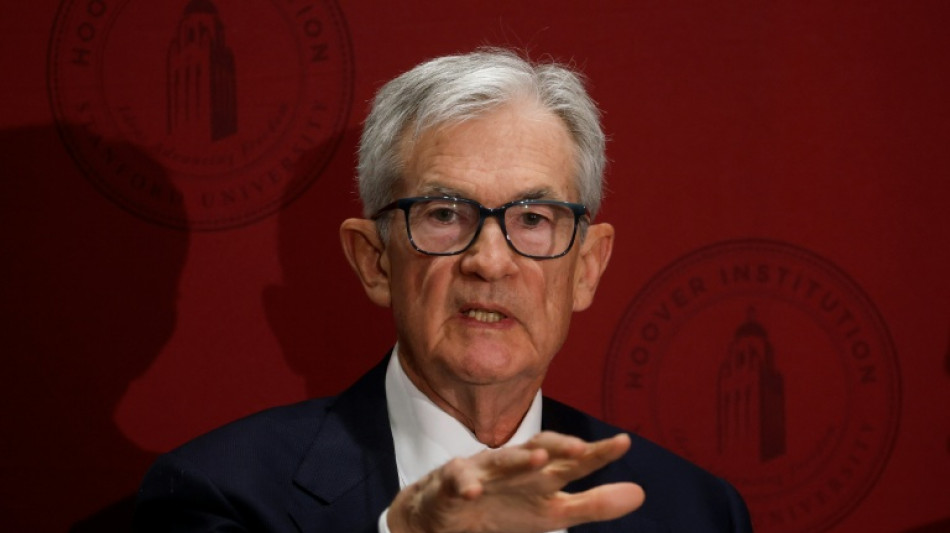

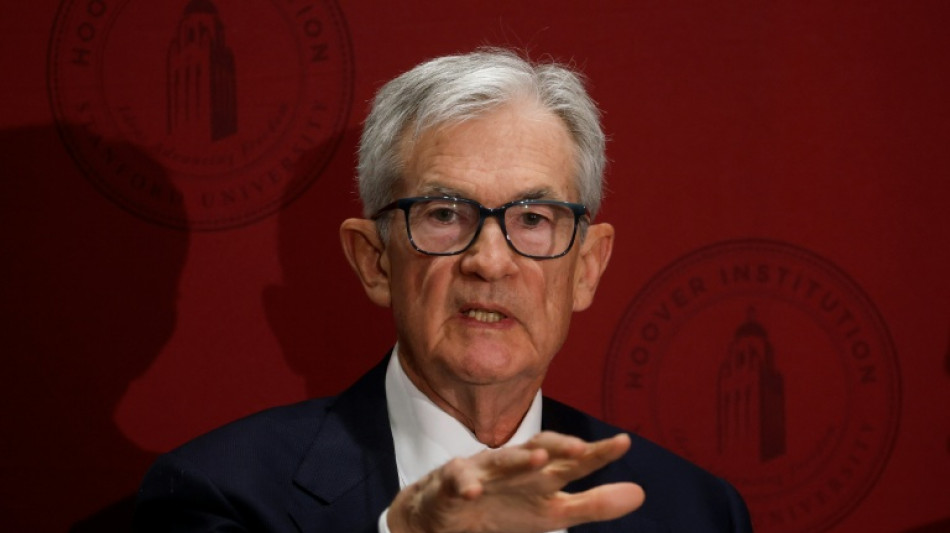

Divided US Fed set for contentious interest rate meeting

While the US Federal Reserve's final interest rate meeting this year could see an unusual amount of division, financial markets view a third straight interest rate cut as nearly certain.

When the Fed last met in October, Chair Jerome Powell asserted that another rate cut in December was "not a foregone conclusion," pointing to "strongly differing views" within the central bank.

Minutes from the Fed's most recent meeting showed many officials expect a further uptick in underlying goods inflation as President Donald Trump's tariffs bite.

But recent comments from leading Fed officials also reflected support for cutting again because of a weakening labor market, even though inflation is still above the Fed's two percent target.

Next week's outcome in the "deeply divided" Fed was "too close to call," UniCredit said, also acknowledging that favorable comments from New York Fed bank chief John Williams towards a cut were a notable "intervention."

"As one of the most senior members of the (Fed committee), it seems unlikely Williams would have said this without Powell's prior approval," UniCredit said.

Policymakers generally hold rates at a higher level to tamp down price increases, but a rapidly deteriorating jobs market could nudge them to slash rates further to boost the economy.

"Usually, as you get closer to a policy meeting, it becomes quite apparent and transparent what the Federal Open Market Committee is going to do," said Nationwide Chief Economist Kathy Bostjancic, referring to the Fed's rate-setting committee.

"This time is very different," she told AFP late last month.

Financial markets rallied following Williams' statement on November 21 that rates could go lower in the "near term."

Futures markets currently show more than 87 percent odds that the Fed will cut rates to between 3.50 percent and 3.75 percent, according to CME FedWatch.

- Dearth of data -

The Fed moved into rate cutting mode this fall, with rate cuts both in September and October.

But a government shutdown from October 1 through November 12 sapped the central bank of most of the key data points for assessing whether inflation or employment is now the bigger priority.

The latest available government data showed the jobless rate crept up from 4.3 percent to 4.4 percent in September, even as hiring beat expectations.

While delayed publications on September's economic conditions have trickled out, the US government has canceled full releases of October jobs and consumer inflation figures because the shutdown hit data collection.

Instead, available figures will be published with November's reports, but only after the Fed's upcoming rate meeting.

The US personal consumption expenditures price index rose to 2.8 percent on an annual basis in September, from 2.7 percent in August, according to delayed data released on Friday.

The "Fed faces a bit of a paradoxical situation," said EY-Parthenon Chief Economist Gregory Daco. "The Fed says these decisions will be data-dependent, but there isn't a lot of data to go on."

Daco expects a "weak majority" to favor another interest rate cut, but believes there could be multiple dissents.

- Looking beyond Powell -

Besides Wednesday's decision, the Fed will also release projections for its 2026 economic and monetary policy outlook.

Next year will already mark a period of significant change with the conclusion of Powell's tenure as chair in May.

Trump, who has relentlessly criticized Powell for not cutting rates more aggressively, signaled this week that his chief economic adviser Kevin Hassett could succeed Powell.

Hassett has appeared to be in lockstep with Trump on key economic questions facing the Fed. But if appointed, Hassett could also face pressure from financial markets to buck the White House on interest rates if inflation worsens.

"The institutional constraints often end up leading appointees towards some level of political independence," said Daco, noting decisions require a board majority.

Whomever Trump picks will need to be confirmed in the US Senate.

While UniCredit predicted "political interference will have a modest impact on Fed policy," deeper consequences cannot be ruled out.

"We have not assumed Trump will get de-facto control of the Fed," UniCredit said, adding that such an outcome is "a non-negligible risk."

P.Sousa--PC