-

Galthie lauds France's remarkable attacking display against Ireland

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

-

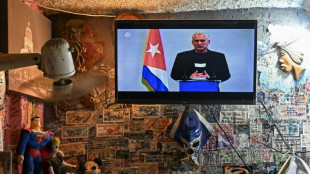

Cuba says willing to talk to US, 'without pressure'

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

Euroclear details 'concerns' over EU's frozen Russian asset plan

EU reassurances over its plan to use frozen Russian assets to help fund Ukraine have failed to quell worries about the untested scheme, the organisation holding most of the funds told AFP.

"We've made very, very clear that we still have concerns," Guillaume Eliet, chief risk officer at Brussels-based clearing house Euroclear, told AFP in an interview.

The European Commission is pushing to tap some 200 billion euros ($232 billion) of Russian central bank assets immobilised in the bloc to provide a desperately needed loan for Kyiv.

Officials are desperate to get agreement on an initial 90 billion euros to prop up Ukraine's finances at an EU leaders' summit on December 18.

But the complex plan -- under which Euroclear loans the money to the European Union, which in turn loans it to Kyiv -- faces resistance from Belgium over fears of potential financial and legal reprisals from Moscow.

The EU's executive has insisted it would put a "three-tier defence" in place that would mean there is "no scenario" under which Euroclear would not be able to get the money to repay Russia if needed.

Under that system the EU says member states can provide guarantees that they will help cover any liabilities.

But Eliet said Euroclear -- a key cog in Europe's financial machinery processing equities, bonds, derivative and investment fund transfers -- still needs convincing that those promises mean it could get the funds immediately if required.

"We need to make sure that in a very short timeframe we can access the liquidity," he said in the interview Monday.

"How can we be reassured that if we need the money on Monday morning we can call out these guarantees?"

Euroclear still holds some 16 billion euros of client assets in Russia that it worries Moscow could seize in retribution -- and it would have to compensate.

While guarantees from EU states were a positive step, Eliet insisted it was unclear how binding they would be if there were political changes in those countries.

"Are we sure that in 10 years down the road we would still be protected?" he said.

- 'Doable' -

A further concern is that the move could be seen as confiscating Russian assets, something the commission insists is not the case.

The company -- which has over 40 trillion euros under custody -- also frets that it would knock confidence in the broader eurozone economy.

"The setup as it's presented today may still be considered, especially by international investors, a signal that maybe Europe is not a safe place to invest in," Eliet said.

As the clock ticks down to the crunch EU summit next week, Eliet said finding a solution was possible, but lawyers needed to "sit down around the table" and hammer out a plan to "reduce or avoid the risks".

"We are happy to sit around the table as well to produce the best framework possible within the short timeframe we have -- it is doable."

In a bid to spread the risk around, Belgium has called on the EU to look to use some 25 billion euros in Russian assets held outside Euroclear.

The commission has said it wants to do that, but EU countries where the funds are stashed have not come forward.

"What we understand is that the preference of the EU would be to go to Euroclear first," Eliet said.

As Russia ratchets up warnings over the plan, Euroclear has stepped up its security measures and is "monitoring the level of threats on a daily basis".

"We are putting in place everything we can to protect our people," Eliet said.

With other EU states including powerhouse Germany pushing hard for the plan, Belgium's fierce objections could be overridden.

There appears little appetite for a fallback plan for the EU to raise the loan itself, which Euroclear still prefers.

European Commission president Ursula von der Leyen has said the loan scheme only needs a weighted majority of countries -- a step Euroclear says would be unwise.

"It is really in the interest of Europe that the member states go together for a solution," Eliet said.

R.Veloso--PC