-

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

-

Scotland coach Townsend under pressure as England await

-

Canadian ice dancers put 'dark times' behind with Olympic medal

Canadian ice dancers put 'dark times' behind with Olympic medal

-

'Exhausting' off-field issues hang over Wales before France clash

-

Crusaders target another title as Super Rugby aims to speed up

Crusaders target another title as Super Rugby aims to speed up

-

Chinese Olympic snowboarder avoids serious injury after nasty crash

-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

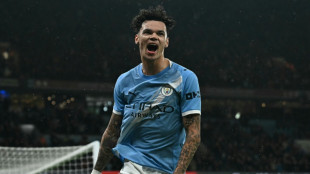

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Most Asia markets rise as traders welcome US jobs

Most equities rose Thursday as investors cheered a bumper US jobs report that eased concerns about the state of the world's top economy, even as they pared back their bets on Federal Reserve interest rate cuts.

The gains were again led by Seoul's Kospi index, the world's best performer this year thanks to a surge in chipmakers Samsung and SK hynix as traders turn to the region's AI plays.

Asia's recent healthy run comes amid a turn from Wall Street titans caused by concerns about extended valuations of firms such as Microsoft and Meta. A diversification among tech plays has also started to play out as companies unveil new AI tools that threaten touch competition for some companies.

Investors have enjoyed a broadly positive few days, which have provided some much-needed stability after last week's upheaval that saw assets from gold and silver to stocks and bitcoin taking a battering.

They took heart from data Wednesday showing 130,000 US jobs were created last month, more than double what was forecast, while unemployment unexpectedly dipped.

The reading soothed concerns about the economy that had been stoked by the previous day's report showing weak consumer activity.

That appeared to offset the fact that the Fed would find it harder to justify cutting borrowing costs next month.

"This was a solid report across headline job creation, unemployment, and wage growth, easing concerns over the health of the US labour market," wrote City Index's Fiona Cincotta.

"Following the data, the markets have pushed back on expectations for the next rate cut by the Federal Reserve to July, compared to June previously."

And National Australia Bank senior economist Taylor Nugent said: "One month’s data does not make a trend, but for a Fed that saw ‘some signs of stabilisation’ in January, this data will only further solidify that assessment.

"There may have been some support from warmer-than-usual weather during the survey week... but it is still an overwhelmingly positive report."

Wall Street's three main indexes ended mostly down with tech firms that have led a surge to record highs in the past two years again underperforming.

But Asia was mostly up.

Seoul rallied more than two percent, with Samsung up nearly six percent and SK hynix more than three percent higher, with observers pointing out chipmakers' crucial role in the AI revolution.

Shanghai, Sydney, Singapore, Wellington and Jakarta were also higher.

Hong Kong, Tokyo and Manila retreated.

The dollar weakened against the yen despite waning expectations for an early US rate cut and the prospect of big Japanese spending after Prime Minister Sanae Takaichi's landslide election win.

Analysts said the yen's advance has been helped by the sense of stability in Tokyo caused by the ruling party's big win.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.1 percent at 57,605.53 (break)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 27,096.50

Shanghai - Composite: UP 0.1 percent at 4,135.91

Euro/dollar: UP at $1.1881 from $1.1874 on Wednesday

Pound/dollar: UP at $1.3638 from $1.3628

Dollar/yen: DOWN at 152.68 yen from 153.14 yen

Euro/pound: DOWN at 87.10 pence from 87.13 pence

West Texas Intermediate: UP 0.4 percent at $64.91 per barrel

Brent North Sea Crude: UP 0.4 percent at $69.65 per barrel

New York - Dow: DOWN 0.1 percent at 50,121.40 (close)

London - FTSE 100: UP 1.1 percent at 10,472.11 (close)

P.Serra--PC