-

Dieng powers Bucks over NBA champion Thunder

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

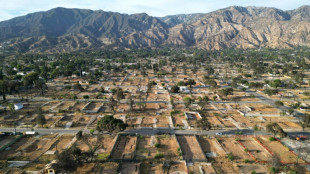

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

Asian stocks track Wall St down but AI shift tempers losses

Most Asian stock markets fell Friday following another tech-led plunge on Wall Street as investors reassess their vast AI investments, while attention was also turning to US inflation data later in the day.

After last week's asset-wide volatility, a sense of calm has descended on trading floors over the past few days, helped by forecast-busting US jobs figures that eased worries about the world's top economy.

However, growing concern about the hundreds of billions spent on artificial intelligence infrastructure -- and the bundles more announced in the past few days -- have fanned speculation about when, if ever, companies will see a return.

That has been compounded this month by the release of new tools that can perform crucial tasks in a range of fields, including legal, sales and marketing, hammering companies worried about competition.

Analysts said that has seen traders reassign investments within the AI area, with the main beneficiaries being chipmakers and other firms needed to build infrastructure.

"Developments in AI, particularly around the rollout of various AGI products, are only vaguely understood, which makes the ability to price future risk and certainty... something of a guess," said Pepperstone's Chris Weston, referring to artificial general intelligence, the mooted next stage of AI when computers could outperform humans across a wide variety of tasks.

And Chris Beauchamp, chief market analyst at IG, added that "investors are rotating away from labour-intensive, fee-based business models that could face margin pressure from AI automation".

"This represents a significant shift from earlier AI enthusiasm, which focused primarily on technology enablers rather than potential losers," he added.

"The speed at which these concerns are spreading suggests markets are becoming more sophisticated in their analysis of AI's impact. Rather than a blanket assumption that AI benefits all companies, investors are now making sector-by-sector assessments of winners and losers."

Those concerns have weighed on US tech in recent months, with Apple, Amazon and Facebook parent Meta among those feeling the pinch, while upstream companies -- many based in Asia -- are enjoying healthy gains.

That saw Wall Street retreat Thursday, with the Nasdaq more than two percent down, while the S&P 500 shed more than one percent. Both indexes are down for the year so far. The Dow also dropped.

Asia was also largely in the red, though the losses were less pronounced, while Seoul -- which has led global markets this year -- was up thanks to advances in heavyweight Samsung Electronics and rival SK hynix.

Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Wellington, Manila and Jakarta were also down after a broadly healthy week.

Precious metals saw some of the heftiest selling this week pushing gold below $4,900 an ounce and silver to $74, though the movements were not as wild as those earlier in the month that sent shockwaves through trading floors.

Attention turns to US inflation figures due later Friday, which come after a bumper jobs report Wednesday saw traders dial down their expectations for a Federal Reserve rate cut next month.

Most now see the next reduction in July owing to signs the economy is faring a little better than initially feared.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.7 percent at 57,226.59 (break)

Hong Kong - Hang Seng Index: DOWN 1.5 percent at 26,637.78

Shanghai - Composite: DOWN 0.3 percent at 4,120.72

Euro/dollar: DOWN at $1.1870 from $1.1876 on Thursday

Pound/dollar: DOWN at $1.3618 from $1.3620

Dollar/yen: UP at 153.11 yen from 152.75 yen

Euro/pound: UP at 87.17 pence from 87.16 pence

West Texas Intermediate: FLAT at $62.85 per barrel

Brent North Sea Crude: FLAT at $67.54 per barrel

New York - Dow: DOWN 1.3 percent at 49,451.98 (close)

London - FTSE 100: DOWN 0.7 percent at 10,402.44 (close)

P.Sousa--PC