-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

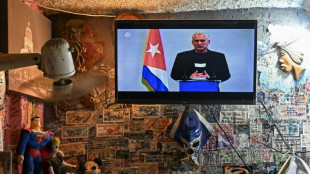

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Markets diverge tracking AI concerns, Gaza deal

European and Asian stock markets traded mixed Thursday as investors assessed the outlook for the global AI-fuelled rally, Federal Reserve interest rates and the US government shutdown.

News that Israel and Hamas had agreed to the first phase of a Gaza ceasefire dampened oil price and defence stocks while gold, seen as a safe haven investment, retreated one day after hitting an all-time high above $4,000 an ounce.

The dollar firmed against main rivals.

"Risk sentiment remains high, US stocks closed at record highs on Wednesday, as traders continue to dismiss fears of a bubble in the AI trade," noted Kathleen Brooks, research director at XTB trading group.

Technology firms have been riding to ever-higher levels this year -- dragging equity markets with them as companies pump hundreds of billions of dollars into all things linked to artificial intelligence.

But there is growing concern that the returns may not match the investment sums, leading to warnings that valuations may have gone too far.

"AI is clearly a bubble," warned Neil Wilson at Saxo markets. "The question is when -- not if -- it blows up. And timing is incredibly hard."

Global politics was another main focus for traders Thursday.

Israel and Hamas have agreed a Gaza ceasefire deal to free the remaining living hostages, in a major step towards ending a war that has killed tens of thousands of people and unleashed a humanitarian catastrophe.

In Asia, the Tokyo stock market closed up 1.8 percent after business-friendly Sanae Takaichi recently became leader of Japan's ruling party.

Paris rose slightly in midday deals as French President Emmanuel Macron races to find a new prime minister after the resignation of Sebastien Lecornu tipped the country deeper into political crisis.

In the United States, Republicans and Democrats appeared no closer to reaching a deal to reopen the government as the row goes into a second week.

Democrats voted for a sixth time to block a Republican stopgap funding measure to reopen government departments.

Democrats refuse to back any funding bill that does not offer an extension of expiring health care subsidies for 24 million people.

Minutes from the Fed's latest interest-rate meeting meanwhile showed divisions among policy makers over cutting borrowing costs.

On the corporate front, shares in HSBC slid in London and Hong Kong after the global banking giant said it planned to buy the remaining 27 percent of its subsidiary Hang Seng Bank for around US$14 billion.

- Key figures at around 1045 GMT -

London - FTSE 100: DOWN 0.4 percent at 9,515.19 points

Paris - CAC 40: UP 0.2 percent at 8,077.35

Frankfurt - DAX: UP 0.3 percent at 24,664.56

Tokyo - Nikkei 225: UP 1.8 percent at 48,580.44 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 26,752.59 (close)

Shanghai - Composite: UP 1.3 percent at 3,933.97 (close)

New York - Dow: FLAT at 46,601.78 (close)

Euro/dollar: DOWN at $1.1616 from $1.1628 on Wednesday

Pound/dollar: DOWN at $1.3379 from $1.3401

Dollar/yen: UP at 152.72 yen from 152.64 yen

Euro/pound: UP at 86.84 pence from 86.78 pence

Brent North Sea Crude: DOWN 0.5 percent at $65.90 per barrel

West Texas Intermediate: DOWN 0.6 percent at $62.18 per barrel

P.L.Madureira--PC