-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

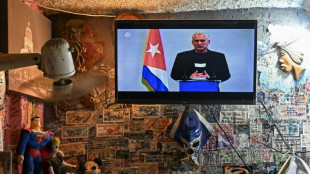

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

How Belize became a poster child for 'debt-for-nature' swaps

When Covid hit Belize, its economy nosedived: closed borders meant fisheries and farmers had no export markets, and tourism centered on the tiny Central American nation's warm waters and wonders of biodiversity came to a halt.

"We lost approximately 14 percent of GDP," Prime Minister John Antonio Briceno told AFP in an interview. Nearly a third of the workforce of the country's 400,000 people were unemployed and there wasn't enough money "to keep the lights on," let alone maintain onerous debt repayments.

Then came a lifeline: environmental nonprofit The Nature Conservancy (TNC) offered to lend Belize money to pay off creditors if it promised to put part of the savings into marine protection.

So-called "debt-for-nature-swaps" are being hailed as an innovative financial tool for preserving ecosystems from climate change and overexploitation, even as critics warn their generosity is overstated and they are far from a cure-all.

Finalized in November 2021, a year after Briceno took office, the deal involved TNC buying back a $553 million "superbond" which held the government's entire commercial debt, negotiating a discount of 45 percent.

This was converted into a $364 million loan "blue bonds" in a sale arranged by Credit Suisse, unlocking $180 million for marine conservation over 20 years.

"For us, it was a win-win, it gave us a breather," said Briceno. Notably, the buyback reduced the country's debt-to-GDP ratio by more than 10 percent.

- Old idea, bigger scale -

Belize's coastline is home to the largest barrier reef in the northern hemisphere, providing significant habitat for threatened species including manatees, turtles and crocodiles.

But warming oceans from climate change, excessive fishing, and coastal development all pose major challenges.

Under the terms of the deal, Belize agreed to expand protection to 30 percent of its territorial waters, and spend $4.2 million annually on marine conservation.

Since then, TNC signed similar agreements with Barbados and Gabon. Ecuador negotiated the biggest swap of all in May, reducing its debt obligations by about $1.1 billion to benefit the Galapagos Islands under an arrangement overseen by Pew Bertarelli Ocean Legacy Project.

Slav Gatchev, managing director of sustainable debt at TNC, told AFP that although the first debt-for-nature swaps happened in the 1980s, now they operate at a far larger scale.

"A third of the outstanding commercial debt to lower and middle income countries is in some form of distress," he said, meaning environmental ministry budgets are stretched and it's hard for governments to invest in nature.

He sees an opportunity to refinance up to $1 trillion of the commercial and bilateral debt, in turn generating $250 billion for climate and nature.

- Paper parks? -

Andre Standing, a researcher for groups including the Coalition for Fair Fisheries Arrangements, told AFP the Belize deal was only possible because the country was about to default and it was therefore better for creditors to accept a lump sum -- rather than the altruistic act it was portrayed as by some.

Moreover, he added, such deals do nothing to address the debt crisis plaguing developing countries.

"That's true, but it's not intended to," Esteban Brenes, who leads conservation finance for the World Wide Fund for Nature (WWF), which is also looking to organize new debt swaps, told AFP.

"We're going to take a piece of the debt and use some proceeds for something better, but by no means are we going to solve the big problem," he said.

Another concern has been that countries might agree to lofty commitments to secure concessions but then fall to "paper park syndrome" where protections exist only in theory.

But Gatchev said the commitments are legally binding and governments could incur fees for breaking them.

"Our reputation as the world's largest conservation organization is on the line here, and we have no incentive to sugarcoat lack of compliance," he stressed.

Briceno, for his part, said the high-profile deal had increased environmental consciousness among his people, who were now quick to report illegal mangrove dredging, for instance.

The debt restructure was "a very good start," he continued, but his country needed far more assistance from the Global North.

"Developed countries destroyed their environment to be able to have development: high-rises, big vehicles, nice fancy homes," said Briceno.

"Now we want the same and you're telling us 'we can't afford you to destroy what we have destroyed' -- then pay us."

P.L.Madureira--PC