-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

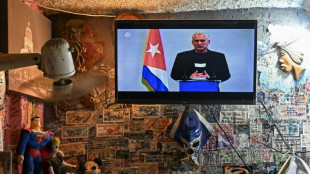

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Banks slow to limit coal financing: NGO

Banks lent almost $470 billion to the coal industry between 2021 and 2023, according to a study published Thursday by German environmental group Urgewald, which criticised the scale of financing amid rising global temperatures.

Of the 638 banks surveyed, only 140 -- or about one in five -- had significantly reduced their exposure to the coal sector since 2016, the report found.

Some 75 banks by contrast saw their investments in coal increase in the same period, according to the study led by the German NGO and partner organisations.

Commercial banks were not reducing the amount they put into the coal industry at a rate sufficient to hit the Paris climate goal to limit global warming to 1.5C degrees above preindustrial times, Urgewald said.

"Without an end to coal financing, it is difficult to imagine that we can get out of coal in time," said Urgewald's finance lead Katrin Ganswindt, calling for more regulation in the area.

In 2023, the banks financed the coal industry to the tune of $136 billion, only 20 percent less than in 2016, according to the study.

More than 90 percent of the financing came from institutions in China, the United States, Japan, Canada, India, Britain and Indonesia.

US banks in particular had seen their investments in coal rise by 22 percent between 2021 and 2023 to $19.8 billion, Urgewald said.

Meanwhile, European banks reduced the amount they gave to the coal industry by 51 percent in the same period to a total of $6.5 billion.

The study comes just after ministers from the G7 developed economies agreed a timeframe for phasing out coal-fired power plants.

The representatives from the United States, Canada, France, Italy, Germany, Britain, Japan set a goal to end their use in the mid-2030s.

In Europe, banks are under increasing pressure from investors and supervisors alike to divest from polluting sectors.

In January, the European Central Bank said that most banks it oversees had not brought their portfolios in line with the Paris targets, leaving them exposed to greater climate risks.

P.L.Madureira--PC