-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

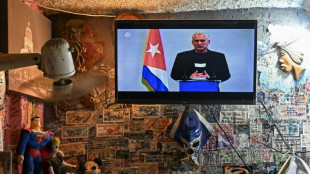

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

US Fed appears set for third rate cut despite sharp divides

The US Federal Reserve is expected to deliver a further interest rate cut Wednesday despite divisions among its ranks, with chief Jerome Powell's ability to secure support from fellow policymakers put to the test.

Financial markets expect a third straight 25 basis points reduction, bringing levels to a range between 3.50 percent and 3.75 percent. This would be the lowest in around three years.

But divides within the Fed have grown even as policymakers voted to slash rates twice in recent months to boost the weakening employment market.

"We look for at least two dissents in favor of no action and one in favor of a larger cut," said Michael Feroli, chief US economist at JP Morgan.

"There are almost equally compelling reasons to cut and to hold," he added in a recent note.

The Fed's rate-setting committee consists of 12 voting members -- including seven members of the board of governors, the New York Fed president and a rotation of reserve bank presidents -- who take a majority vote in deciding the path of rates.

Powell noted in October that inflation separate from President Donald Trump's tariffs is not too far from officials' two-percent target.

But the costs of goods have risen on the back of Trump's wide-ranging levies this year, and some officials are cautious that higher prices could become persistent.

The Fed pursues maximum employment and stable prices as it decides the path of interest rates, although the goals can sometimes be in conflict. Lower rates typically stimulate the economy while higher levels hold back activity and tamp down inflation.

- 'Risk management' -

Powell will likely be able to "persuade several hesitant policymakers to support a third consecutive 'risk management' rate cut," said EY-Parthenon chief economist Gregory Daco.

This comes as the most recent available figures confirmed a slowdown in the jobs market, while a government shutdown from October to mid-November delayed the publication of more updated federal data.

But Daco also expects Powell to signal "firmly that additional easing is unlikely before next spring," unless there is material weakening in the world's biggest economy.

This is because rates are close to "neutral," a level that neither stimulates nor restricts economic activity, analysts believe.

Feroli of JP Morgan observed that most Fed governors appear to favor lowering rates, while most reserve bank presidents seem inclined to keeping them unchanged.

But New York Fed President John Williams' remarks that there was room for another cut in the near-term tilts the balance.

"We believe he was speaking for the rest of the leadership," Feroli said, referring to Powell and Vice Chair Philip Jefferson. "This should weigh the votes firmly toward a cut."

Meanwhile Fed Governor Stephen Miran, who is on leave from his role heading the White House Council of Economic Advisers, is expected to push for a larger rate cut.

- Litmus test -

This week's gathering is the last before 2026, a year of key changes for the central bank -- including the accession of a new chief and tests of its independence as political pressure mounts.

In an interview with Politico published Tuesday, Trump signaled that he would judge Powell's successor on whether they immediately cut interest rates.

Asked if this was a "litmus test" for his handpicked candidate, Trump responded "yes."

Powell's term as Fed chair ends in May 2026, and Trump has hinted that he wants to nominate his chief economic adviser Kevin Hassett to the top post.

Hassett currently chairs the White House National Economic Council, and appears to be in lockstep with the president on key economic questions facing the Fed.

If appointed, however, Hassett could also face pressure from financial markets to diverge from the White House on interest rates -- particularly if inflation worsens.

Miran's term as governor also ends in January, creating an opening among the Fed's top officials. And Trump has sought to free up another seat in attempting to fire Fed Governor Lisa Cook earlier this year.

Cook challenged her ousting, and the Supreme Court barred the president from immediately removing her while awaiting oral arguments on the case in January.

A.F.Rosado--PC