-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

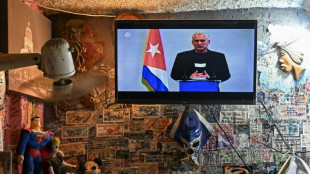

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Stocks retreat ahead of Fed decision

Stock markets mostly fell and the dollar steadied Wednesday following a tepid day on Wall Street as investors bided their time ahead of a highly anticipated Federal Reserve policy announcement later in the day.

London managed a slight rise, while most European markets slipped around midday after a lacklustre session in Asia.

With US central bankers expected to cut interest rates for the third straight session on Wednesday, the main focus is on their post-meeting statement, Fed boss Jerome Powell's news conference and the "dot plot" forecast for 2026 policy.

"While there is a 90 percent chance of a rate cut at this meeting, the outlook is less clear," said Kathleen Brooks, research director at traders XTB.

"In the lead up to this meeting, bond traders are scaling back their expectations for future rate cuts, with only two further reductions expected throughout 2026," she added.

After November's tech-led swoon, stock markets have enjoyed a healthy run in recent weeks as weak jobs figures reinforced expectations for another step lower in borrowing costs.

But that has cooled heading into the Fed gathering following the release of US inflation data that was slightly higher than expected.

US data on Tuesday showing an uptick in job openings -- against estimates for a drop -- further tempered expectations for a string of cuts next year.

Still, there is some hope that the Fed will turn more dovish next year with US President Donald Trump's top economic aide Kevin Hassett -- the frontrunner to succeed Powell in May -- saying he sees plenty of room to substantially lower rates.

After a weak showing Tuesday in New York, where the S&P 500 and Dow dropped, Asia fared no better Wednesday.

Tokyo, Sydney, Singapore, Seoul, Mumbai, Wellington, Jakarta and Manila all fell, though Hong Kong and Taipei edged up.

Shanghai dropped even as data showed China's consumer prices rose last month at their fastest pace in almost two years, following an extended period of deflationary pressure in the world's second-largest economy.

The price of silver hit a record high at $61.6145 an ounce owing to high demand for the metal used by industry as well as for making jewellery.

It topped $60 for the first time Tuesday also thanks to supply constraints.

Investors are also keenly awaiting earnings from software giant Oracle and chipmaker Broadcom, which will be used to judge the outlook for the tech sector in the wake of huge investments in artificial intelligence.

Markets have been pumped higher for the past two years by the surge into all things AI, though there has been some concern of late that the hundreds of billions splashed out might not see returns as early as hoped.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.1 percent at 9,649.85 points

Paris - CAC 40: DOWN 0.5 percent at 8,013.40

Frankfurt - DAX: DOWN 0.5 percent at 24,035.46

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,602.80 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 25,540.78 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,900.50 (close)

New York - Dow: DOWN 0.4 percent at 47,560.29 (close)

Dollar/yen: DOWN at 156.77 yen from 156.90 yen on Tuesday

Euro/dollar: UP at $1.1631 from $1.1630

Pound/dollar: UP at $1.3307 from $1.3300

Euro/pound: DOWN at 87.40 pence from 87.43 pence

Brent North Sea Crude: UP 0.2 percent at $62.08 per barrel

West Texas Intermediate: UP 0.3 percent at $58.44 per barrel

A.Santos--PC